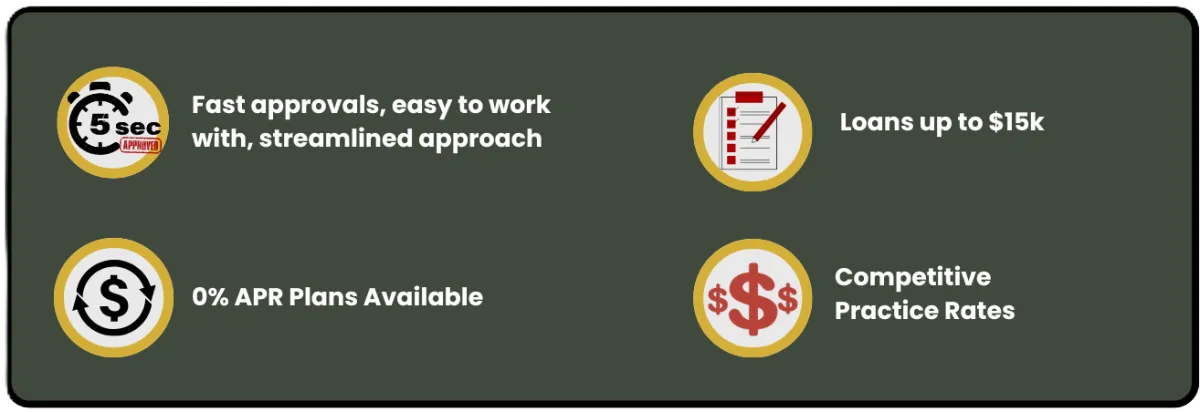

PATIENT FINANCING MADE SIMPLE

Empower Your Patients. Grow Your Practice.

IPS and TRX Services simplify the financing process, making it more accessible to a broader range of patients.

Our patient financing solution benefits both patients and medical practices by providing a flexible payment option

Help your patients say "yes" to care—with quick approvals, flexible plans, and peace of mind for your practice.

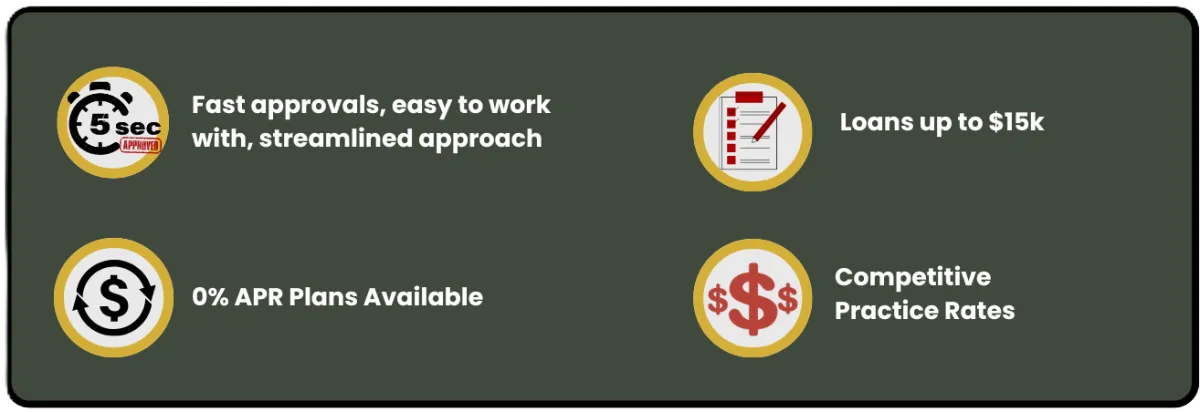

PATIENT FINANCING MADE SIMPLE

Empower Your Patients. Grow Your Practice.

IPS and TRX Services simplify the financing process, making it more accessible to a broader range of patients.

Our patient financing solution benefits both patients and medical practices by providing a flexible payment option

Help your patients say "yes" to care—with quick approvals, flexible plans, and peace of mind for your practice.

Surgery

Wellness

Products

Vision Correction

Procedures

Surgery

Wellness

Products

Vision Correction

Procedures

PATIENT-CENTRIC FINANCING

Easier Access to Capital

IPS simplifies the financing process, making it more accessible to a broader range of patients. By streamlining applications and employing more inclusive approval criteria, IPS ensures that more individuals can secure the funding they need for essential procedures.

Lower Interest

Rates

Understanding the financial burden of medical procedures, IPS offers competitive interest rates. This approach helps patients manage their finances more effectively, reducing the long-term cost of their medical care and alleviating financial stress.

Flexibility on Fund Usage

Unlike many traditional financing options, IPS doesn't restrict how patients use their funds. This flexibility allows individuals to cover not just the primary procedure costs but also related expenses such as medications, follow-up care, or retail products.

PATIENT-CENTRIC FINANCING

Easier Access to Capital

IPS simplifies the financing process, making it more accessible to a broader range of patients. By streamlining applications and employing more inclusive approval criteria, IPS ensures that more individuals can secure the funding they need for essential procedures.

Lower Interest

Rates

Understanding the financial burden of medical procedures, IPS offers competitive interest rates. This approach helps patients manage their finances more effectively, reducing the long-term cost of their medical care and alleviating financial stress.

Flexibility on Fund Usage

Unlike many traditional financing options, IPS doesn't restrict how patients use their funds. This flexibility allows individuals to cover not just the primary procedure costs but also related expenses such as medications, follow-up care, or retail products.

PROVIDER COMPARISON

PRACTICE RATES

PROVIDER COMPARISON

PRACTICE RATES

Still Have Questions or Ready to Get Started?

If you have questions, feel free to schedule a call with our team to explore the best solution for your practice.

Ready to move forward?

If you’re ready, simply fill out the form to apply for your patient financing account.

Still Have Questions or Ready to Get Started?

If you have questions, feel free to schedule a call with our team to explore the best solution for your practice.

Ready to move forward?

If you’re ready, simply fill out the form to apply for your patient financing account.

FAQs

When will I get my money?

The next business day.

What are my customers Annual Percentage Rates (APR)?

Because we are able to leverage private capital to fund the loan. We are able to offer some of the most aggressive rates in the industry as we aim to keep cost low for you and your customer. Based upon the customers individual credit score they will have an APR of 0-21%.

Do my customers have to pay a deposit?

No, there is not any deposit required

How long does my practice application take to get approved?

On average we approve and board our merchants within 24-72 business hours.

What recourse do you have on the loans?

Our program is a non-recourse loan. Therefore, once you are paid we take the responsibility of the customer paying us. Refunds and Chargebacks from the customer still are the responsibility of the merchant

How long does it take the patient to get approved?

Instantly, the patient will know if they are approved or declined within seconds

How low of a FICO score can the patient apply with?

Every individual credit score is different, but patients with scores below 600 can definitely gain financing approval.

FAQs

When will I get my money?

The next business day.

What are my customers Annual Percentage Rates (APR)?

Because we are able to leverage private capital to fund the loan. We are able to offer some of the most aggressive rates in the industry as we aim to keep cost low for you and your customer. Based upon the customers individual credit score they will have an APR of 0-21%.

Do my customers have to pay a deposit?

No, there is not any deposit required

How long does my practice application take to get approved?

On average we approve and board our merchants within 24-72 business hours.

What recourse do you have on the loans?

Our program is a non-recourse loan. Therefore, once you are paid we take the responsibility of the customer paying us. Refunds and Chargebacks from the customer still are the responsibility of the merchant

How long does it take the patient to get approved?

Instantly, the patient will know if they are approved or declined within seconds

How low of a FICO score can the patient apply with?

Every individual credit score is different, but patients with scores below 600 can definitely gain financing approval.